Delaware imposes this tax for companies hoping to maintain good standing within the state. This tax can come as a surprise to business owners but fear not. We’ll cover everything you need to know about the franchise tax. A corporation with 5,000 shares or less is required to pay $50 reporting fee and $175 tax ($225 in total).

The Delaware state site URL to file your annual report and pay the franchise tax is also listed below for easy access. If your company was incorporated in a certain year but was inactive for a period of time during the year, you can report this in the “inactive period” section and pay less taxes. There is more information below on this subject. I don’t understand why I have to pay franchise taxes. Every Delaware-based corporation must pay the Delaware Franchise tax.

- Regardless of whether they are actively doing business, all corporations and LLCs have to file reports and pay franchise taxes.

- If you don’t pay the Delaware Franchise Tax for your Delaware Corporation for two consecutive years, your corporation will be administratively dissolved by the State of Delaware.

- The period is also the same for Limited Partnerships.

- In the state of Delaware, all corporations are required to file an annual report and pay a franchise tax.

- Corporations with 5,000 or fewer shares will pay the minimum tax.

It has nothing to do with the actions or the income of your business; it is only required to keep your business operating. Franchise Tax is the tax collected by the state of Delaware for the right to own a Delaware company. This tax has nothing to do with the income or activity of the company. The state of Delaware requires you to maintain it as the standing status of your company. Form your US LLC & C-Corp in minutes and handle taxation, accounting and bookkeeping. Remote & easy US company setup from anywhere in the world.

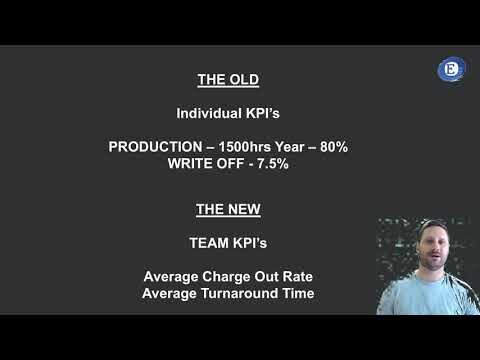

Assumed Par Value vs Authorized Share Method

Those figures are used to calculate the assumed par value of the corporation’s stock and then its total assumed (not actual) par value capital. The tax rate under this method is $400 per $1,000,000 or portion thereof of the corporation’s assumed par value capital. The Delaware franchise tax for Corporations can vary depending on the number of stock shares, the number of stock shares issued, and their par value. The minimum tax ranges from $175 to $400 depending on specific circumstances. A Delaware Corporation’s franchise tax is the lesser of the two amounts under the authorized shares and assumed par value capital method calculated using total gross assets, not income.

- Their franchise tax is calculated upon the number of shares they have.

- If your APVC is $1,000,001, you do not owe $350, you must round up to $2,000,000, which means you owe $700.

- Many Delaware corporation owners form companies and authorize huge numbers of shares (millions, in some cases).

- The annual report must be filed online, and there is a filing fee of $50.

- Here are the two methods of calculating Delaware franchise tax, and what you can do to lower your tax bill.

The Delaware Franchise Tax applies to all corporations in Delaware. Whether you have financial activity during the year or not, Statement Balance vs Current Balance you must file a Delaware Franchise Tax return and pay any taxes owed. Non-profit organizations are exempted from Franchise Tax.

UCC & Corporate Due Diligence

To use this method, you are required to list all the assets and shares your company has. It is quite a complicated process of calculation. Please feel free to contact us to get help about this method. However, for LLCs, LPs and LLPs, they are only required to pay an annual tax. Taxes should be received by the Delaware Department of State on or before June 1st of each year.

Luckily, there’s a less expensive alternative. So the State of Delaware sent you a friendly message, letting you know you owe them thousands of dollars in franchise tax. Cenk has more than 30 years of experience in accountancy and strategy as the ex-CFO and board member of PepsiCo subsidiaries. He is a US CPA and a Strategic CFO from Wharton. He probably knows your business and will add more value than you can imagine. Cenk and his team have supported more than 300 U.S. businesses with their services and advisory, with their personal touch.

The minimum tax for companies using the Assumed Par Value Capital Method is $400. With either method the maximum tax is $200,000, unless the company has been identified as a “large corporate filer,” in which case their tax will be $250,000.00. A Delaware Certificate of Good Standing is a document issued by the Secretary of State that shows the ability of a corporation to do business. If you have an overdue Delaware franchise tax, The Secretary of State will not issue a Good Standing status for your company.

Filing an annual report and paying franchise tax is also required to maintain a company’s good standing in Delaware. Not filing and paying means your company cannot obtain a good standing certificate and Delaware will declare your company void. Many Delaware corporation owners form companies and authorize huge numbers of shares (millions, in some cases).

If you can not file on or before March 1st deadline, you can file later but would have to pay some penalty and interest. Corporations must list all directors and at least one officer on their annual report, to comply with Delaware laws. If the Annual Report and remittance is not received by the due date, a $125.00 penalty will be added to filing fee. There are two ways to file a Delaware annual report. Are you an investor looking to establish your company in a prime location?

What Is an Annual Report?

Delaware offers privacy protection, ease of management, and a favorable business environment that promotes growth and success. Taxpayers owing $5,000.00 or more pay estimated taxes in quarterly installments with 40% due June 1st, 20% due by September 1st, 20% due by December 1, and the remainder due March 1st. The penalty for not filing a completed Annual Report on or before March 1st is $200.00 Interest at 1.5% per month is applied to any unpaid tax balance.

You’ll find a list of tax years during which your business has been eligible for franchise tax. Next to the year you’d like to file for, click File Annual Report. Most non-US owners, without a physical presence in the US, have a US mailing address and their local country office address (or home-office) as the principal place of the business address. Gross assets may differ for accrual basis and cash basis balance sheets. If you have filed tax returns previously, you would know whether you are cash or accrual basis.

Business Tax Calendar

You must pay Franchise Tax to maintain “good standing” status for your company. If you don’t pay your Franchise Tax, it will always stay in the records of the Delaware Division of Corporations and you will pay a penalty for late payment which is $200. Also your company will be penalized at 1.5% interest for every month it remains unpaid. Delaware Corporations are also required to file an annual report besides paying the Franchise Tax. Foreign corporations that wish to do business in the state of Delaware are required to file an annual report with the secretary of state on or before June 30th every year.

All corporations utilizing either method will face a maximum tax of $200,000. However, if identified as a Large Corporate Filer, the maximum tax reaches $250,000. Many businesses (and specifically eCommerce businesses) are registered in Delaware. The Franchise tax obligations for your Deleware business will depend on whether your business entity is formed as a limited liability company (i.e., LLC), partnership or a corporation.

The state of Delaware offers many benefits for small business owners, including a favorable tax environment. The franchise tax is the only tax that anyone who wants to start a business in Delaware must pay. In this article, you can find all the information you need to know about the Delaware franchise tax. Get an easy-to-follow explanation about what forms you’ll need, information about registration fees, filing deadlines, naming requirements, and more. If the resulting par value is higher than the par value you set in your corporate charter, it will be used to calculate your franchise tax liability. If the par value in your charter is higher, that number will be used instead.

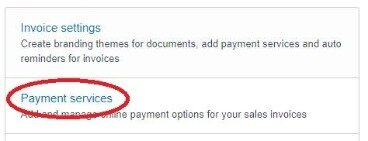

How to pay Delaware franchise tax

Incorporate in the US and get access to the greatest startup ecosystem in the

world. All-In-One Place, 100% Online at e-Delaware.com with our exclusive Company Management

Platform. Hiring full-time employees in multiple US states? Chances are your startup will need to register your Delaware corporation to do business as a foreign corporation. Capbase is a team of designers, engineers, and business professionals spread across 6 time zones on 3 continents united by our passion for dogs, coffee, and great software. Please bear in mind that these are the addresses of the individuals and for most non-US owned businesses, these are non-US addresses.

If you don’t know, consult with your bookkeeper, accountant or tax preparer. You can always reach out to us for professional help. Set a budget for taxes so you don’t scramble to raise funds at the last minute.

There’s an added fee of $50 to file the annual report. Therefore, the minimum Delaware franchise tax and annual report payment total is $225 a year for Delaware domestic corporations. If the corporation has 100,000 authorized shares, it must pay $1,015 ($250 plus $765 [$85 times 9]). If the corporation wants to really go big or go home and has authorized 1,000,000 shares, it must pay a whopping franchise tax of $8,665 ($250 plus $8,415 [$85 times 99]). In the state of Delaware, all corporations are required to file an annual report and pay a franchise tax.

The total gross assets should be the “total assets” reported on US form 1120, schedule L (federal return) for the company’s fiscal year ending the calendar year of the report. The tax rate considered in this calculation is $400 per million. To utilize this approach, you need to provide the numbers for all shares issued (including treasury shares) and the total value of gross assets in the designated sections of the corporation’s annual report. The total gross assets should correspond to the “total assets” figure reported on the U.S.

No Comment